Life Insurance Digital Marketing Agency

You need to know how long you spent searching for the right insurance digital marketing agency. Finding a marketing partner who prioritizes your objectives and aligns with your values isn’t easy. Elit-Web will get you results you never thought possible.

-

220%average ROI of our clients

-

1000successful projects in marketing

-

3,5mleads for customers generated

a new level with Elit-web

Grow Your Insurance Business with Our Targeted Digital Marketing

Digital marketing strategies that target specific groups of people have a limited reach, but they can be more accurate and effective than mass marketing because they are tailored to the needs and preferences of particular consumers. Insurance companies can use custom ads as a cheap way to get new customers, make their brand more well-known, and increase their sales. This is an opportunity to use this strategy in your daily marketing plan. Elit-Web can help you create a digital marketing strategy that focuses on the target audience’s needs and market insights. This strategy will help you outperform competitors in the insurance industry, which is always changing.

How Digital Marketing Agencies Help Insurance Companies Attract More Customers

We believe insurance marketing services must be available for every currently running business. The results are the first target for every marketing agency since outcomes are what you expect. This way, an agency can help you establish a market presence, manage data-driven campaigns and a limited budget, and ensure transparent reporting on your journey.

Insurers can establish trust by responding confidently and sharing valuable knowledge. The aim is to make it readily available for the customers to engage with them — whether through mobile, digital messaging, or in-person.

To remain competitive, insurance companies must take a proactive strategy to comprehend their policyholders' demands, reconsidering their current offerings, and having the necessary reliable experts.

The insurance market needs more customer experience, partly attributed to insurers' infrequent contact with policyholders. To achieve customer demands, insurers must engage them, but they must first know how customers prefer to be contacted.

The simplest way to do it is to meet client demands without having extra sales staff. Based on surveys, clients in German-speaking states want active, tailored product details from insurers. They also voiced a desire for an easier way to sign contracts online and for loyalty rewards.

We are chosen

More than cases

The budget for website promotion depends on various factors. We will form a complete list of work and estimate the cost.

We will increase the number of applications by at least 15-20%

Reduce the click price by 25-30%

Decrease the conversion price by at least 20%

Digital Marketing Services for Insurance Companies

Elit-Web offers a wide range of marketing services for insurance companies for any objective. Whether you require tailor-made strategies to attract reliable clients or establish your brand’s reputation and influence, we have expertise in preparing working strategies. Hundreds of clients who partnered with us earlier still consider Elit-Web’s internet services a practical approach. So, read about the benefits of every service we offer in further sections.

Search Engine Optimization (SEO)

SEO (Search Engine Optimization) is the best solution that enhances the visibility of a business website, making it easier for the potential target audience (clients) to find it on popular search platforms. Essentially, many Internet users strive to quickly find what they are looking for and use regular online search (Google or others) to do so. Thanks to competent online marketing, it is possible not only to demonstrate the presence on the World Wide Web but also to establish it permanently. By implementing high-quality services for insurance agents, one can increase sales volumes, improve organic traffic flow, and make the business more popular, relevant, and in demand.

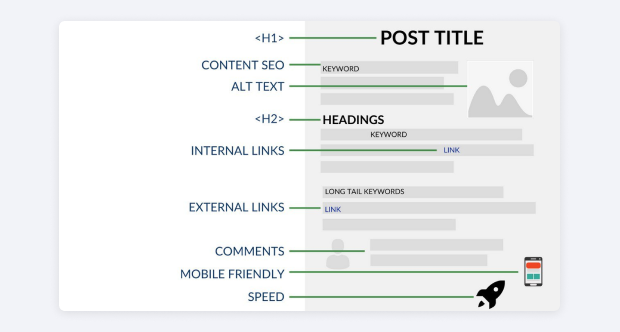

On-Page Optimization

Competent on-page optimization is aimed solely at increasing traffic to the brand’s website. This relevant tool helps improve ranking and appear in higher positions on popular search platforms (Google and others). Well-thought-out steps in a strategic action plan, combined with informative and well-written content, contribute to increased profits and the achievement of qualified lead generation. If a business owner decides to partner with Elit-Web, they will be able to receive high-quality service without spending a fortune, obtain optimization for their website, and achieve the desired results.

Off-Page Optimization

Professional off-page optimization is primarily about increasing the authority of a business website, improving its ranking, and enhancing its status, image, and reputation. The fact is that link building is another effective way to make yourself known. Therefore, by filling external sources with useful content containing links to the main business website, there is a chance to achieve excellent results in popular search engines. In digital marketing for the insurance industry, it is very important to order a complete set of services at once, which includes creating engaging content for social media, producing guest posts, and more.

Technical SEO

This approach optimizes startups and larger insurance companies’ websites to help search platforms find, crawl, interpret, and index web pages. Technical SEO also helps increase a brand’s visibility and rankings, but it focuses mainly on the website’s technical part (e.g., on the site’s structure). Partnering with a reliable agency offering technical optimization strategies will ensure multiple advantages, including building meaningful connections with the audience. Marketing experts are the key to successful inbound marketing, allowing your insurance business to connect with the right audience and nurture customer loyalty.

Local SEO

Thanks to location-based optimization, your insurance business will be able to engage with potential local clients who are actively searching for your offers. As a rule, this leads to an increase in revenue and profitability. Insurance market participants can outperform their competitors at the local level by focusing on local optimization (and, for example, adding email marketing), which makes it a profitable investment. The main advantage of Elit-Web’s insurance services lies in the fact that the team of experts will search for long-tail keywords that take local intent into account, guaranteeing you only those phrases that will actually work.

Pay-Per-Click Advertising (PPC)

The most affordable strategy for reaching all of those internet users who are seeking insurance is PPC advertising. With this strategy, you can bring the company in front of them at the optimal time when they are already looking for you. Heading marketing campaigns for your insurance business, we’ll target keywords with intensified traffic in search yet with low competition. This way, your offerings can make the most of the limited budget and ensure that the right audience views ads. Additionally, tailor-made ad copies for the marketing campaign are also critical points for us.

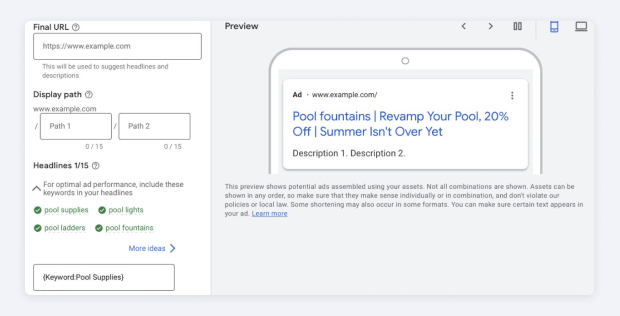

Google Ads Management

Many marketers consider you to have immense potential if you ignore the Google Ad Manager. Because it’s the foundational publisher monetization platform with profitable capabilities that manage all the advertising campaigns. This is where the ad campaigns will be created and executed, with automatic data accessible to assess measurable results. Elit-Web’s offerings for the company are also based on the precise localized targeting of your ads. We have the expertise to fine-tune ads to appear in specific locations while aligning with effective keywords, making them more relevant to the audience you want to reach.

Ad Copywriting and A/B Testing

With the first strategy, you can tackle prospects forward to your company’s sales funnel. Captivating web copy and ad copywriting will convince prospective consumers to go further along the sales funnel, view the site, peruse the product listings, and conclude orders. The second method evaluates the execution of both versions of content to determine what is more appealing to the audience. This compares a controlling A version and a variant B to identify the most effective one, considering their execution metrics. A/B testing could enhance the conversion rate by up to 25%. That’s a significant boost in execution that could turn more website visitors into customers who purchase.

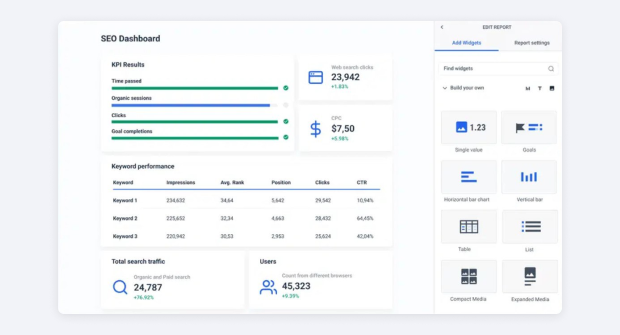

Campaign Optimization and Performance Tracking

Overall, campaign optimization is the ongoing procedure of adjusting and upgrading your marketing efforts to reach the highest potential returns. It entails assessing and taking advantage of data-driven insights for tactical changes, ensuring the campaign effectively reaches the intended audience and meets the critical metrics of performance (KPIs). These metrics are essential to monitoring since they enable an obvious line of insight into the future rewards of your efforts. When displaying cost-effective per-target analytics, you can rationally indicate that the allocated budget you spend on marketing has been used efficiently and continues to deliver targeted results.

Conversion Rate Optimization (CRO)

The insurance business could increase the efficiency of ongoing initiatives by simplifying the conversion path, resulting in more leads turning into loyal buyers. It leads to higher measured returns, enabling the company to attract clients at a reduced cost. Moreover, distractions such as needless products’ other options, links, and details could be reduced, increasing the conversion rate. We recommend you remove or minimize anything on the landing pages irrelevant to users taking action on the website.

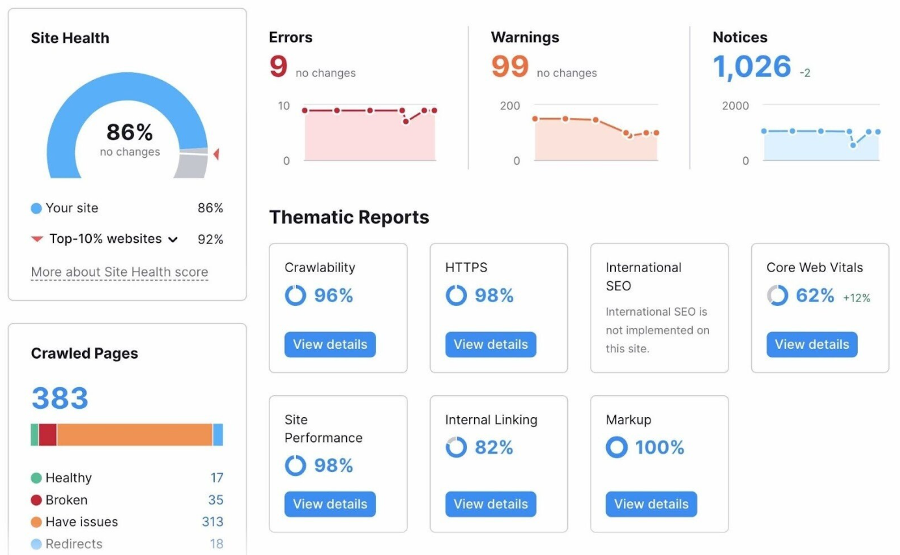

Website Audits and Detailed Analysis

In addition to delivering a breakdown of the content on the website, an audit identifies locations where the site lacks the data the audience is looking for. By analyzing the website’s content deficiencies, you can better prepare to generate fresh material to ensure more value to the website and business. If you conduct a website audit regularly, you can identify and resolve serious performance issues with the website immediately. When addressing website issues, you can ensure customers have a positive experience with your company.

Landing Page Optimization

It is vital to modify the landing pages from time to time to convert online visitors, namely leads, into regular customers — even a barely increased conversion rate on this page could result in significant revenue generated. When the landing page language and the worth of your offering are inconsistent with the advertisement, the visitors might lose conviction and leave this page, causing the conversion rate to fall. You can be confident regarding the execution of the landing pages since Elit-Web’s team still accompanies the business, leading you out of the crowded market with the right outcomes.

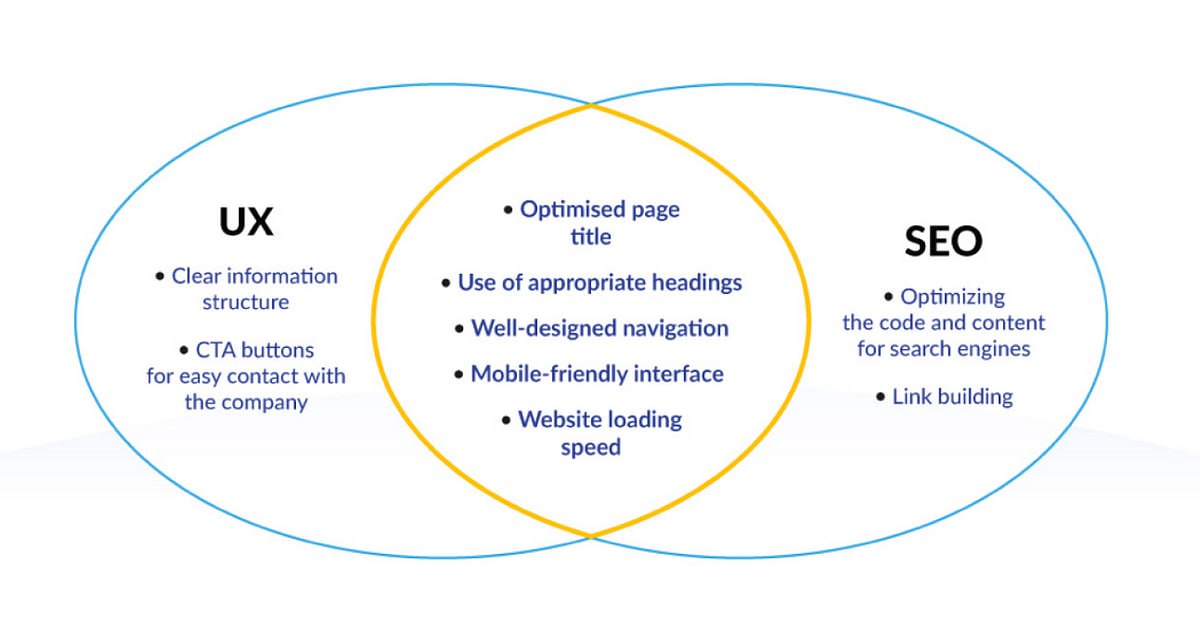

User Experience (UX) Enhancement

Effective UI/UX design will make the product more inviting to new customers, increasing user retention and acquisition. If consumers appreciate your product and find it engaging, they are more likely to stay around and enjoy it. UX done effectively can drastically reduce bounce rates on the website! The figures reflect themselves. An unsatisfactory customer experience led to 89% of consumers switching to competitors. 39% of users will abandon a website if graphics are not loading or take too long to appear.

Why Choose Elit-Web as Your Insurance Digital Marketing Agency

When this is about marketing startups, we get serious — when the turn of larger enterprises comes, we remain open-minded and deliver precise and personalized marketing strategies. While your company relies on our marketers, we invest all the knowledge to advertise.

First, Elit-Web thoroughly takes on market insights to determine what potential, pros, and cons your insurance company will have. To draw in the intended audience, we look at the business from the customers’ side — such actions are mandatory to understand what customers want for real and expect when visiting you.

With us, you’ll know how the budget allocated for marketing was spent and the percentage of return on investment (ROI) your insurance business will generate. All the metrics on the website’s circulation in Google searches and other measures will be reached with the results your business truly deserves.

Elit-Web aligns with your business goals, so we realize the importance of documenting all the prep work and further steps before you succeed in the chosen competitive market. During our partnership, you’ll receive the most out of the insurance services’ potential in front of buyers while achieving the objectives in success.

Frequently asked questions

How does insurance marketing work?

Insurance marketing entails recognizing and focusing on the proper customers, then engaging them with innovative, hard-to-resist strategies demonstrating why your insurance offerings are their best option. Indeed, it could include an appealing website, eye-catching flyers, or catchy online ads, but there’s considerably more to it beyond that.

Do insurance companies need marketing?

Absolutely. Because prospering in the insurance industry requires an effective marketing strategy to increase the company’s recognition and stay in touch with potential clients. Insurance services are invisible and untouchable, existing solely as commitments. Offering a promise implies confidence, a conviction that the service provider will be reimbursed if the loss occurs.

How do you create a marketing plan for an insurance company?

Your marketing plan’s purposes and features from the start include market research, personalized messages that address specific target groups and locations, platform decision-making, and metrics that track the outcomes of marketing and reporting schedules.

How do I get more customers for my insurance?

Highly successful acquisition strategies rely on reaching consumers at the appropriate moment. Insurers can conduct an analysis using what they have access to their clientele to identify trends and predict when consumers will be searching for a specific product or service.

What Industry expertise in digital marketing do you offer?

We`ll analyze your competitors and create a successful digital strategy